Introduction

If you’ve been treating the eTIMS rollout as just another administrative headache, consider this your final wake-up call. The Kenya Revenue Authority (KRA) has drawn a clear line in the sand.

In a public notice dated November 7, 2025, KRA announced that starting January 1, 2026, all income and expenses declared in your tax returns will be automatically validated.

What does this mean for your money?

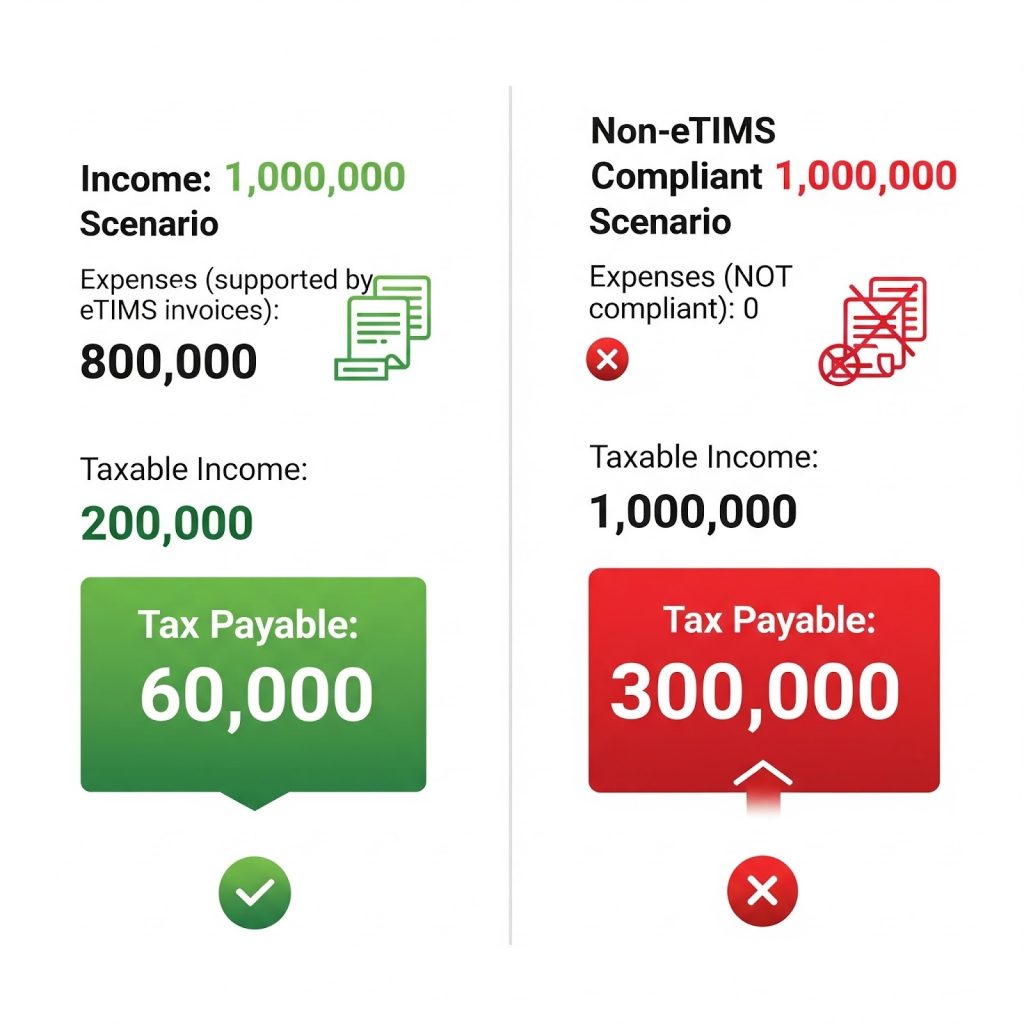

Any expense that is not supported by a valid eTIMS-compliant invoice will be instantly rejected. Your claimed expenses will be disallowed and your taxable income will be higher.

In other words, non-compliance simply means you end up paying more tax. See the scenario below assuming a 30% rate.

Your eTIMS Questions, Answered.

________________________________________________________________________________________________

Q: I thought eTIMS was already a requirement. What’s new?

You’re right. eTIMS has been a mandatory requirement since January 1, 2024.

What’s new is automated enforcement. Before non compliance was a risk. Now, it’s a guaranteed penalty.

From 1st January 2026, the iTax system itself will be the auditor, validating your returns upon submission. The grace period is over.

Q: How does this impact professional service providers like consultants like law firms, trainers or coaches?

This is a critical point of potential confusion.

Every professional service firm is required to be on eTIMS, including sole proprietors and non-VAT registered businesses.

eTIMS is not about VAT. It is about validating your income.

If you issue invoices, you must issue them through eTIMS.

Q: What about suppliers who operate informally, like farmers, Gikomba traders, or jua kali artisans?. What should I do?

This is the biggest pain point for product-based businesses. If your supplier cannot issue an eTIMS invoice, you must reverse the invoice on their behalf through your own eTIMS account.It doesn’t make the supplier compliant, but it protects you.

It’s like going to the market, buying vegetables, and the seller forgets to give you a receipt. Instead of walking away empty-handed and getting in trouble later, you pull out your own receipt book and write the receipt for them (and for your records). You record what you bought, from whom, for how much, and the tax details.

In eTIMS language:If your supplier doesn’t issue an eTIMS invoice, you log into eTIMS and generate one on their behalf, so your books stay clean, and KRA can see the transaction

Q: I’m in the service industry, like training or consulting (not law). My services are VAT-exempt. Surely this doesn’t apply to me?

This is a dangerous misconception.

It does.

Whether your service is taxable, exempt, or zero-rated, income must still be validated.

The eTIMS system is a validator of income and expenses , not just VAT. It is a transaction evidence.

The eTIMS requirement applies to all persons engaged in business, whether or not they are registered for VAT.

When you invoice for a VAT-exempt service, your eTIMS invoice will simply and correctly reflect a zero rate. This is how you validate your declared income.

Q: What if my supplier is a legitimate, PIN-registered company, but they just refuse to issue an eTIMS invoice?

This places the entire tax risk on you.

From a legal and tax perspective, the advice is blunt: if they won’t issue an eTIMS-compliant invoice, don’t trade with them.

If you pay for that supply or service, you will have no valid invoice to support the expense. KRA will disallow it, and it will come directly off your bottom line. You must make this a non-negotiable part of your supplier onboarding.

Q: Does the eTIMS invoice really need my business PIN on it?

Yes.

Yes. This is the core of the system.

Your PIN links the supplier’s invoice to your claimed expense.

An invoice without your PIN cannot be validated.

Q: Are There Any Exemptions?

Yes, but the list is narrow and specific. The eTIMS requirements do not apply to the following transactions:

- Emoluments (i.e., salaries and wages)

- Imports

- Investment allowances

- Interest income

- Air passenger ticketing

- Statutory deductions and payments like withholding tax

Your Strategic Action Plan: What to Do Today

The 1st January, 2026 deadline is not far off. Businesses that wait will face a painful financial reckoning.

Here is your immediate action plan.

- Conduct a Supplier Audit. This is your number one priority. Divide your suppliers into two groups: those who are eTIMS compliant and those who are not. For the non-compliant, you must either train them, implement a reverse-invoicing process, or find new suppliers.

- Train Your Finance and Procurement Teams. Your staff must be your first line of defense. They must be trained to reject any invoice that is not eTIMS compliant.

- Ensure Your Own House is in Order. You must be compliant in issuing eTIMS invoices for 100% of your sales, regardless of whether they are taxable or exempt.

- Review Your Record-Keeping. With KRA building analytics to cross-check all your data, your internal records must be flawless. This automated system will expose any inconsistencies.

Disclaimer : An eTIMS invoice does not erase the responsibility to maintain proper supporting documentation such as contracts, delivery notes, LPOs, and service agreements. eTIMS validates the transaction, but your supporting documents prove the substance behind it.

Businesses that adapt now will secure their tax positions and reduce audit exposure. Those that don’t will finance the difference.

If you need tailored support, you are welcome to book a customised one hour tax strategy session with us. We will assess your business structure, develop a compliance roadmap, and equip your team before the deadline arrives.

_________________________________________________________________________________________________

Authors:

Waithira Mugo & Mike Ogutu.

Contact us: info@wmcoadvocates.co.ke

Disclaimer – This Article is in general terms for guidance only and is not intended to substitute professional advice. While due diligence has been undertaken, in ensuring the accuracy of information provided herein, Waithira M & Co. Advocates is not responsible for any actions or omissions undertaken as a result of the same.